WENIA, is an app that makes it easy to buy, sell, send, and receive Bitcoin (BTC), Ethereum (ETH), Polygon (MATIC), and USDC. Alongside these digital assets, they’ve also introduced a stablecoin called COPW, which is pegged 1:1 to the Colombian Peso (COP). COPW, like many other stablecoins, is created and managed using blockchain and smart contract technology. You can find the whitepaper on their webpage: WENIA COPW Whitepaper.

Smart Contract.

COPW is stored and managed by a smart contract deployed on the Polygon network. It essentially automates the minting, transfer, ownership, allowance and other relevant rules and functions related to the use of the token within this blockchain.

Proxy Contract: 0x1d22c334621364F16f050076eE15Acd5eb8225Ce

Implementation Contract: 0x919E5Ab16F885422D080196A1d0507D182b94274

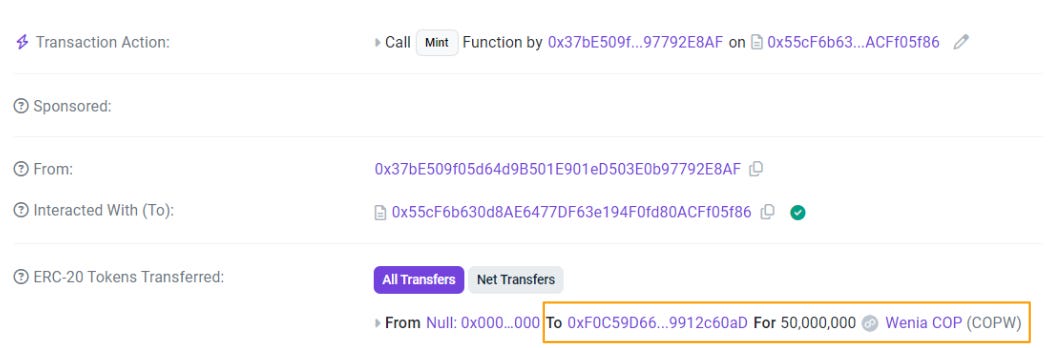

Minting

The amount of COPW that can be created is restricted by the total reserve value of Colombian Peso (COP) and other assets backing the token. This minting process is governed by the smart contract in which the token (COPW) is stored and managed, and is done by allowing the contract to interact with what are known as oracles, which feed data to the contract to update the current reserves, which imposes a limit in the total quantity of tokens that can be issued on a certain moment, thus ensuring continuous parity and liquidity with the external reserve.

“If the amount of COPW to be minted, when added to the circulating supply, exceeds the reported reserve value, the system will automatically restrict the creation of new tokens” [source: Wenia whitepaper]

Total Supply + Issuance Quantity <= Total Reserve (1)

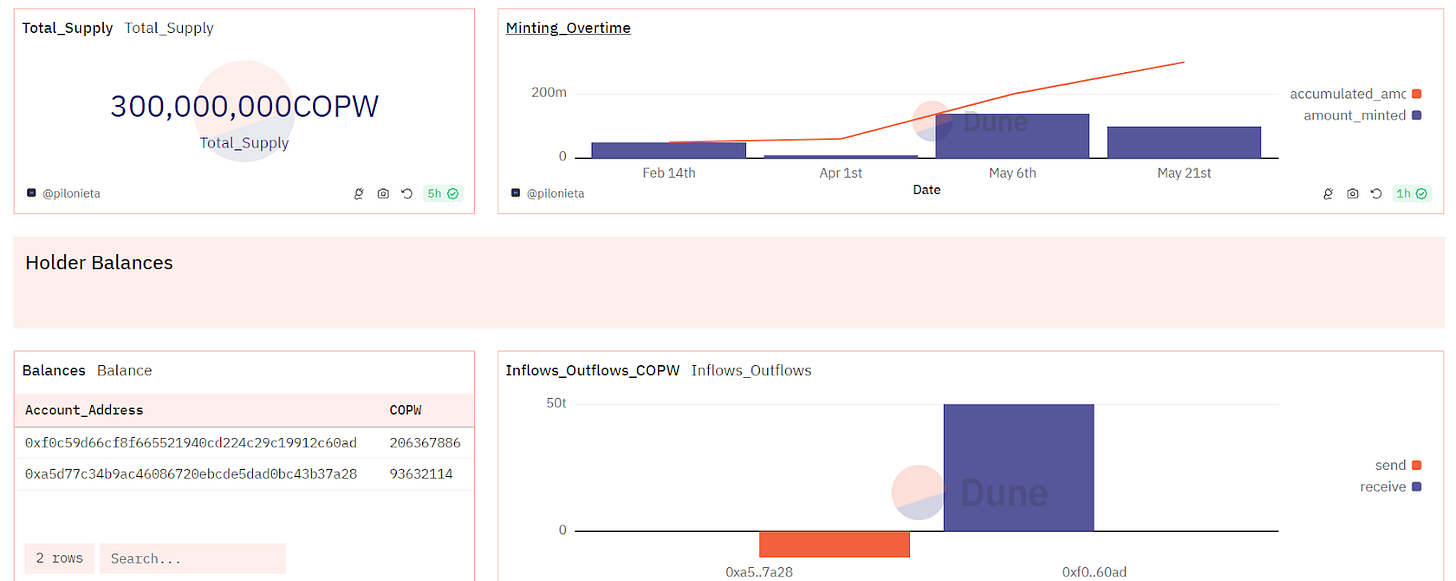

So far, 300.000.000 COPW have been minted, because this is a stablecoin pegged to the Colombian Peso, this amount corresponds to 300.000.000 COP. You can check this number and other related metrics on polygonscan and in our dashboard made with Dune analytics.

Segregation of Digital Assets

Currently, the COPW token is segregated into two accounts: one for clients and another for Wenia's operational assets, because of this, as far as I know, individual ownership of the token COPW is not on-chain, and according to the whitepaper, this ownership is individualized and identified within an omnibus account that guarantees the correct quantity of COPW tokens belonging to each owner. Nevertheless, we can still get some insights of the two accounts mentioned which correspond at the moment to the holders of the token.

Wenia Operational Account Address: 0xF0C59D66cF8F665521940Cd224c29c19912c60aD

Clients’ Account Address: 0xa5D77c34b9Ac46086720ebCDe5DAD0BC43b37A28

We assume the Wenia Operation account is the one that gets the amount of token minted every time. Feel free to comment on this.

At the moment the distribution of the total supply of COPW is between WENIA’s operational account and clients’ account, 61% and 31% respectively. You can explore further in my dashboard at https://dune.com/pilonieta/wenia-copw

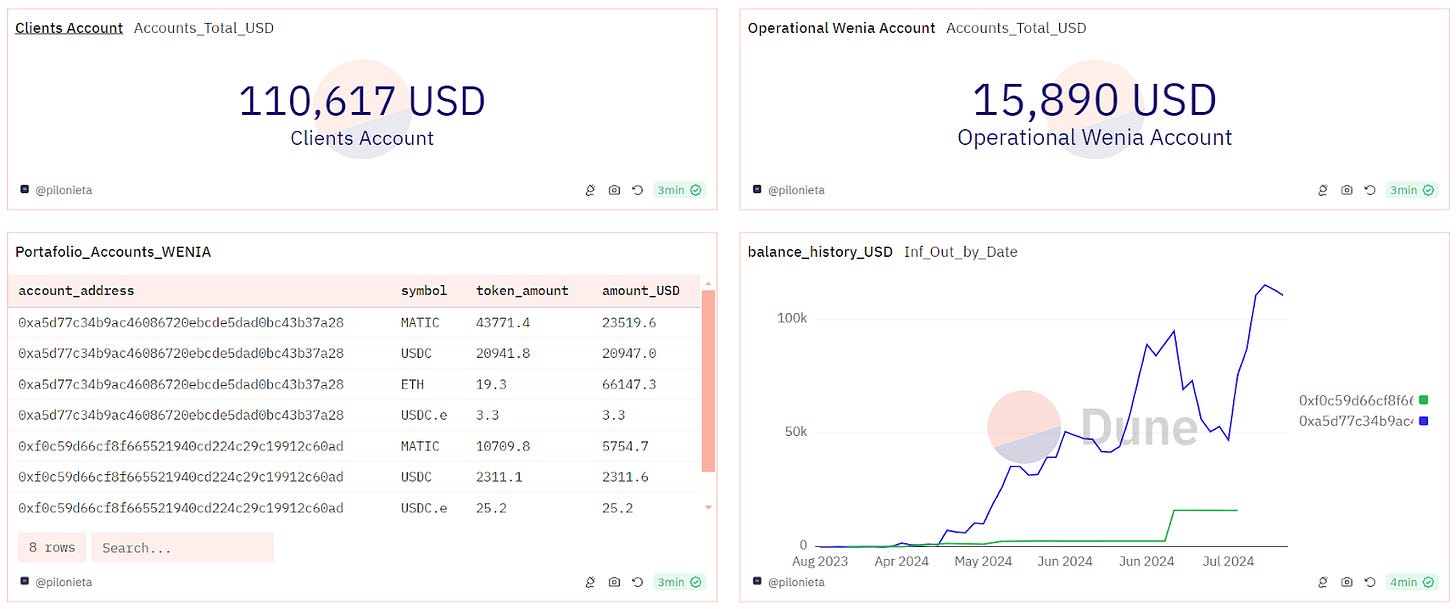

Portafolio

Besides the token COPW, there are other holdings in the Operational and Clients’ account. Currently, the portfolio on the Polygon network includes MATIC, USDC, and USD.e. We searched the aforemetioned account addresses on the Ethereum blockchain and found accounts with matching addresses. While this does not necessarily mean they are WENIA accounts, upon examining their interactions, we found that most interactions occur between them. This suggests that the addresses, as on the Ethereum network, correspond to the WENIA Operational and Clients’ account. You can explore further on the portafolio in my dashboard at https://dune.com/pilonieta/wenia-copw

Interactions

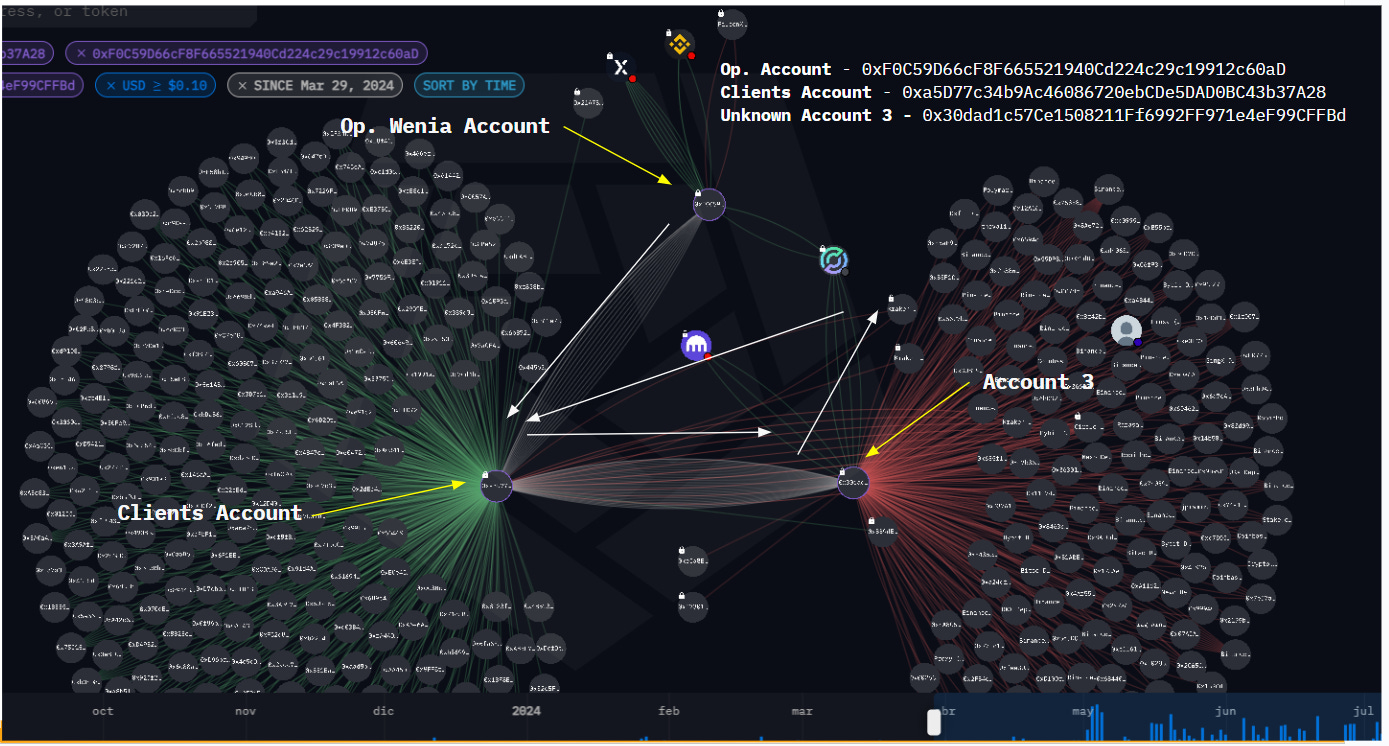

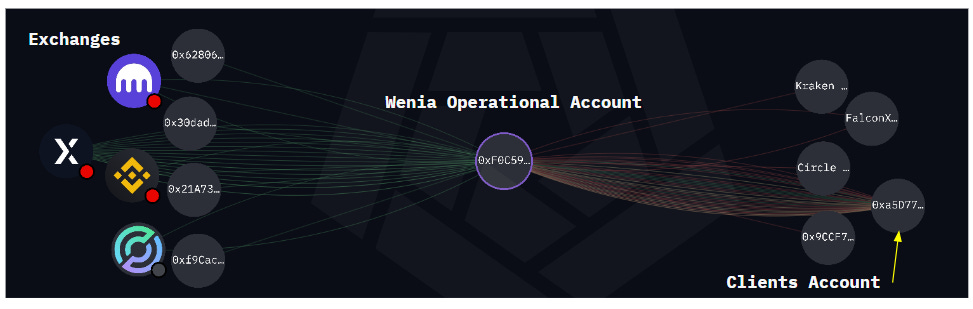

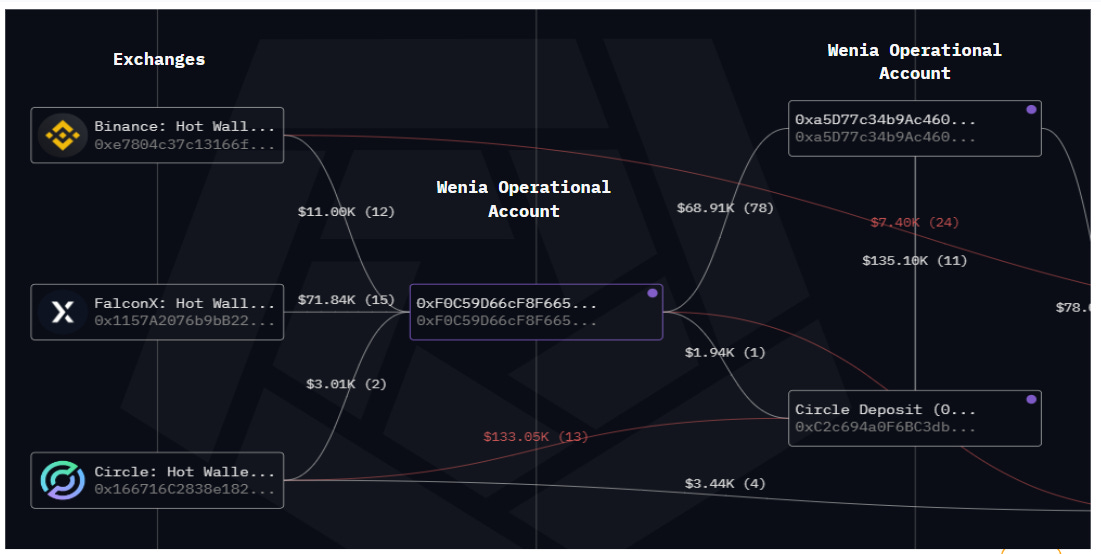

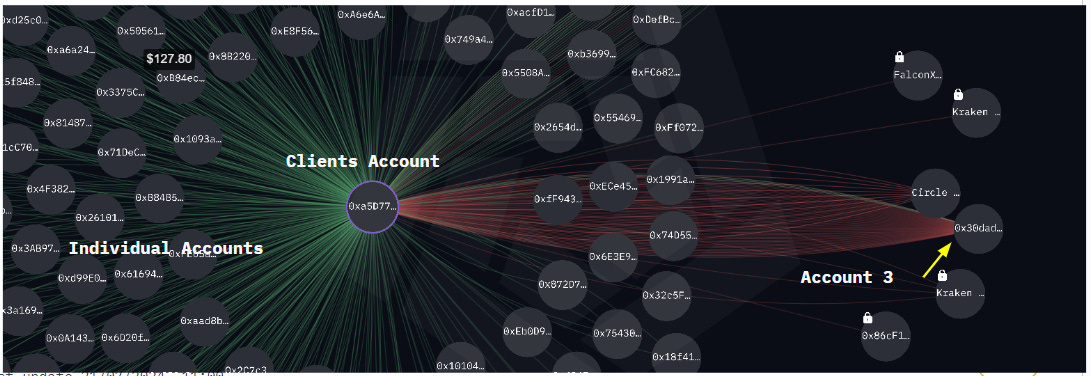

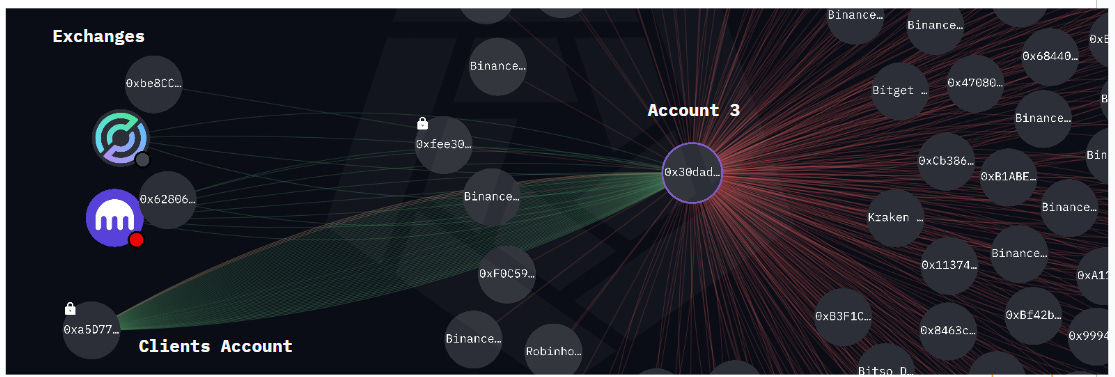

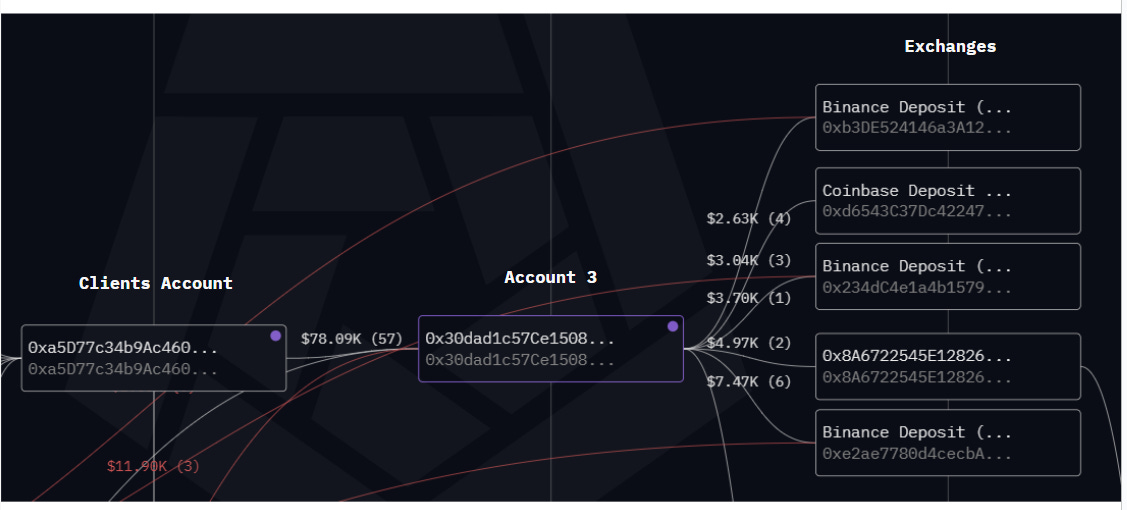

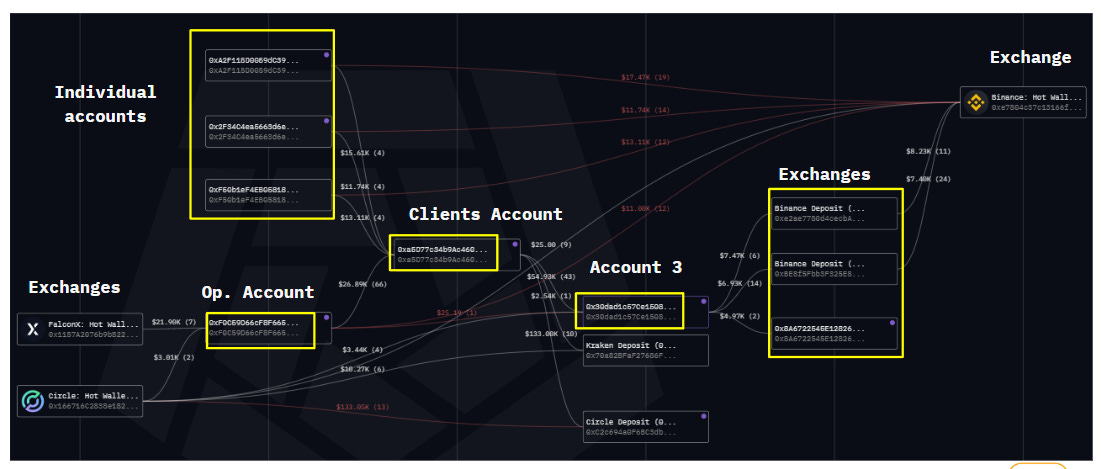

Using Arkham Intelligence, we created a graph to extract the most relevant interactions between the Operational and Clients’ accounts. The graph shows outflows and inflows in USD for USDC, USD.e, MATIC, and ETH.

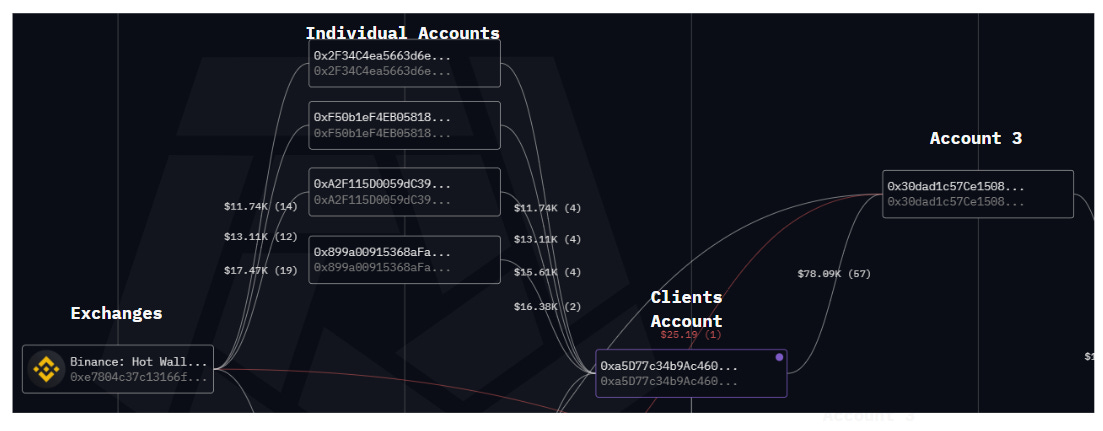

The graph reveals not only the relationships between the Operational and Clients’ accounts but also other interactions, such as inflows from exchanges to the Operational account and inflows from individual accounts to the Clients’ account. A third account stands out, let's call it Account 3 (0x30dad1c57Ce1508211Ff6992FF971e4eF99CFFB), located on the right of the graph, it interacts frequently with the Clients’ account, centralized exchanges, and individual accounts. To summarize, these are some of the most relevant interactions in terms of volume up to 22/07/2024:

Wenia Operational Account - 0xF0C59D66cF8F665521940Cd224c29c19912c60aD

Exchange Uses

Withdrawals from Falcon X and Binance for approximately 71.74K USD and 11 K USD respectively

Outflows to Clients’ Account for 68K USD approximately.

Clients’ Account - 0xa5D77c34b9Ac46086720ebCDe5DAD0BC43b37A28

Exchange Uses

Deposits to Circle for 135.7K USD and Kraken 2.59K USD

Deposits to Account 3 for approximately 78K USD.

Deposits from individual accounts for 320K USD approximately.

Account 3 - 0x30dad1c57Ce1508211Ff6992FF971e4eF99CFFBd -

Exchange Uses

Deposits to Binance for an estimated of 33.9K USD, Bybit 2.5K USD, Kraken 2.3K among others.

Withdrawals from Circle for 3.4K USD.

Here's an image connecting what I just described, outflows in white and inflows in red:

Relevant links and sources.

Data Sources up to 22/07/2024